Business Barometer Survey - Q2 2025

Real-time private company data; how C-level execs are thinking-feeling-reacting

Over the past few months, I’ve been working behind the scenes on something I think we need more of in today’s private market environment; more real-time data and insights on how C-Level Execs are feeling, thinking, and reacting to the whipsaw of changing economic conditions.

There’s no shortage of headlines or hot takes about where the economy is heading. But most of it is lagging or anecdotal or simply “hot-take opinions”. We wanted to know what CEOs, CFOs, and other operators are actually thinking and doing right now, the decisions they’re making, the pressures they’re feeling, and how confident they are heading into the next few quarters.

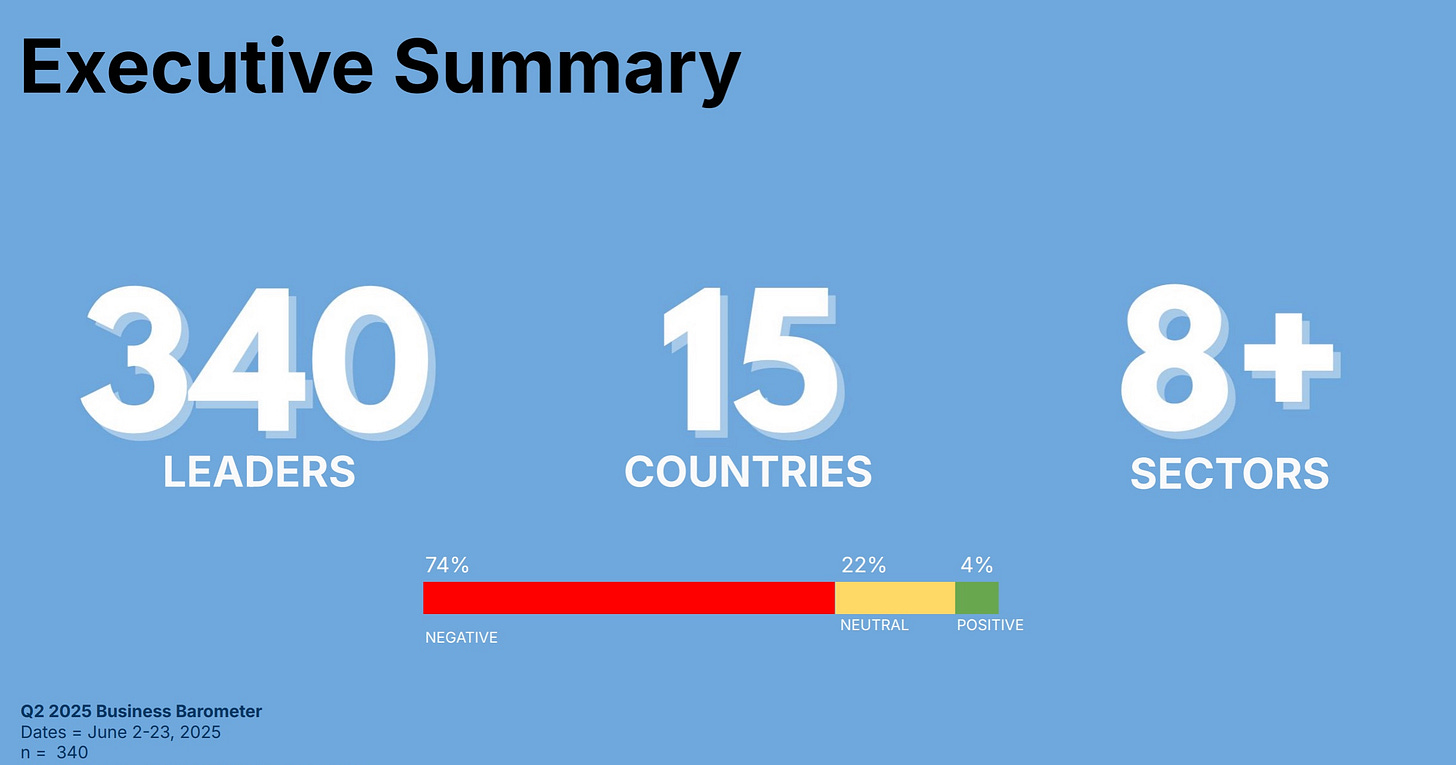

So I helped brainstorm, structure, and deliver this survey by partnering up with Paul Witkay and team at the Alliance of CEOs, and also teamed with other leadership organizations including Operators Guild and Founders Circle Capital, to create the first Business Barometer Quarterly Survey; a real-time snapshot of the Business pressures and plans being made for primarily private companies of less than $1B valuation and less than 1,000 employees.

Version 1.0: Q2 2025 is our “Business Barometer Survey” launch. Our vision is to produce this survey quarterly. I think of it as the corollary to the oft quoted Consumer Confidence Survey/Index from Michigan reported widely on CNBC, Bloomberg, and other business outlets.

Survey Goals: Thinking/Feeling/Reacting: To simply provide real-time data from C-Level Execs of mostly private companies of less than $1B value and mostly less than 1,000 employees.

3 Key Topics (Question Areas) - we designed these to stand the test of time - since we intend to survey quarterly.

Sentiment (their mood)

Economic Pressures (across 12 key business categories)

Actions being taken; Plans being made

Survey Demographics?

340 Respondents (85% CEOs, CFOs, Board of Directors) and ~50 other C-Level Execs

81% are $10M-$100M companies; 19% are $100M-$1B+

90% of companies are under 1,000 employees (66% under 100 employees)

Key Insights (Q2 2025 Survey)

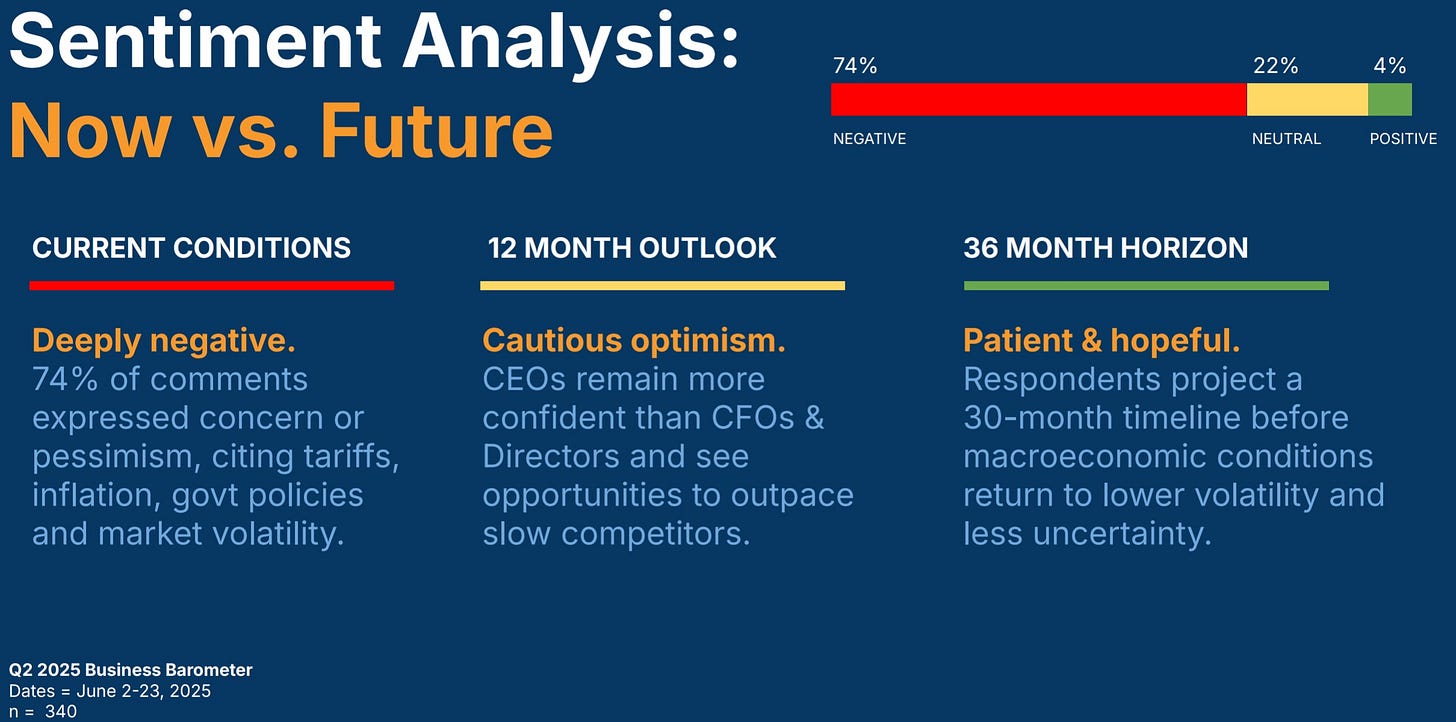

74% negative sentiment; 22% Neutral; Only 4% were positive

Out of 12 Economic Categories - only Technology and Ai Adoption were marked as “Tailwinds”. The other 11 categories were rated moderate to heavy pressure

55% believe we have 12-24 months before “more normal”

Nearly 1/3 believe we have 36 months or more before “more normal”

I know we all want and need more data about private market companies of this size and scale (primarily private market, under $100M, and under 1,000 employees)

So we did what any operating exec would do… WE BUILT IT.

Enjoy!

Link to the full Business Barometer report here: https://www.benchboard.com/resources