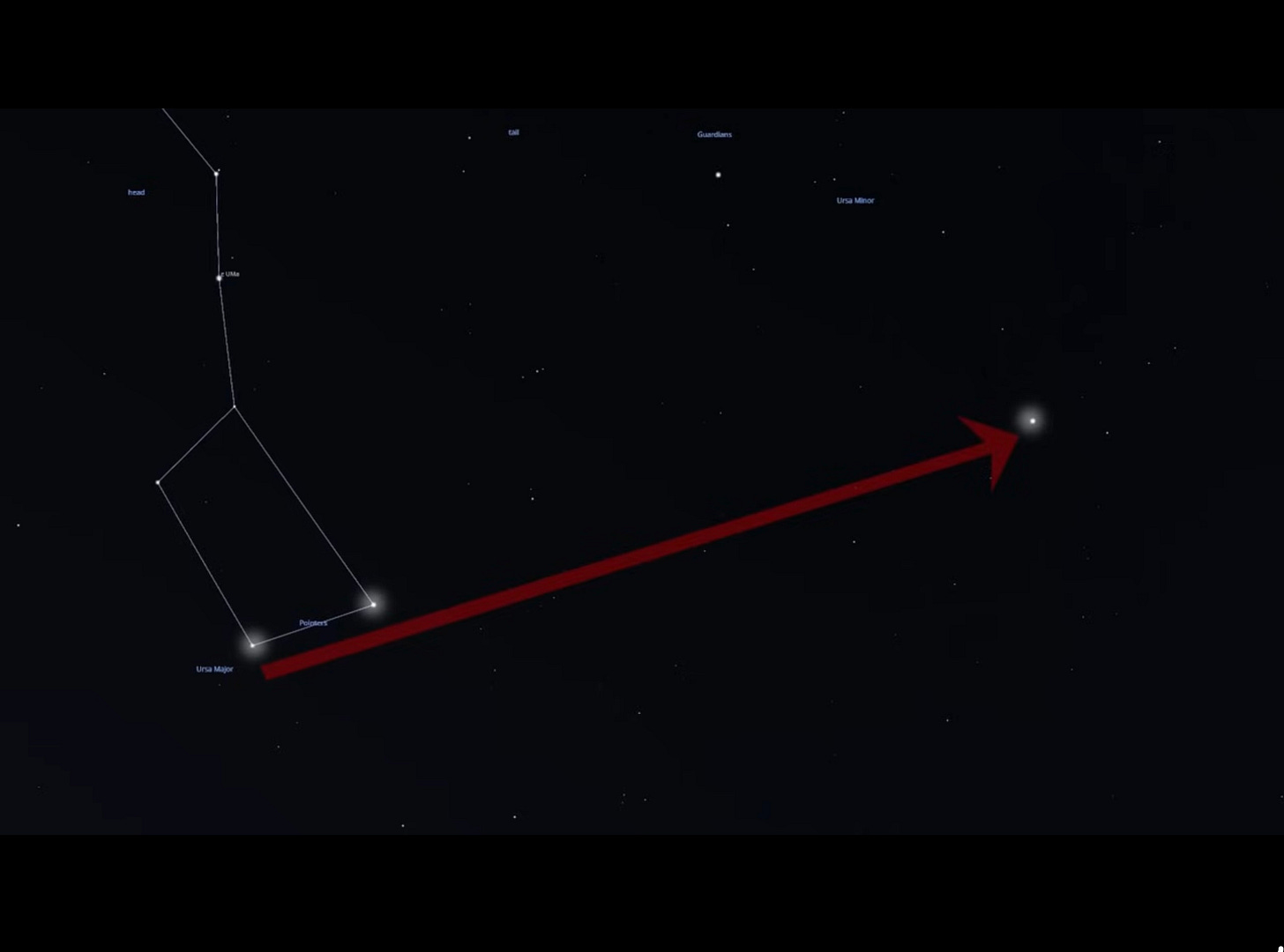

North Star Thinking

How CFOs anchor a company's decision-making culture...

This post is a recap of one of my recent CFO client leadership coaching sessions. We hit on three critical levers a modern CFO must pull: First Principles thinking, board and executive team alignment, and creating a truly data-driven decision culture.

Suffice it to say I was on a roll. You know that feeling when you know you are “on”? I was “on” this day.

This was a standard 90-minute session of my “Best Of’s” delivered to my client in real time. It was also one of those rare sessions where nearly every concept we touched could be immediately applied inside the walls of their fast-scaling business.

Here’s the distillation of our conversation… she and I both knew it was a great conversation, and I could see her wheels turning. My wheels also began turning, and I knew this had to be my next PlayBook post.

1. Build the Culture Before the Model: 3-5 Metrics that Matter

Data doesn’t drive decisions. A “Decision Culture Based On Data” does. You can have a full BI stack and still not make better choices if the org isn’t trained to ask, “What does the data tell us to do next?”

She and I zeroed in on this: anchor decision-making around just 3-5 key success metrics. Not 30 KPIs. Not dashboards that require a PhD in Tableau.

Define a data-to-decision loop:

Collect the right inputs

Pre-wire how and when you’ll decide (e.g., “When conversion drops below X for 3 weeks, we pivot. If conversion goes above Y for 3 weeks, invest more.”)

Execute the decision

Course-correct fast

This structure aligns the team around what matters, when to act, and why confidence can sometimes beat certainty.

2. First Principles Sit Above Strategy; The Foundations of Your Operating System

Whether it’s a tough board meeting, an dysfunctional executive room, or a challenging investor call, the CFO’s secret weapon is having a clear point of view (POV) delivered with confidence anchored in 1st principles. Confidence begins and ends with these First Principles “Anchors” as she called them (I’ve called them Islands of Safety in the past).

She and I talked through how to anchor every major discussion to 3-4 unshakable truths: First Principles that defined her company’s strategy, risk posture, and go-to-market approach.

Why are these First Principle Anchors so critical?

Anchors like this defuse tense moments which are usually created by unimportant and confusing rabbit holes.

They immediately re-focus the conversation to the pre-agreed and most-important alignment checkpoints.

They shift the conversation from fear and “what ifs” to priorities and “must-dos.”

In her next executive meeting, I smiled when she said she will now be focusing on aligning her team on the company’s (and her own) First Principles before the meeting even starts. She is intent on “having the meeting before the meeting” by having key 1:1 conversations to align these First Principle finance philosophies. Then, when the conversation gets noisy (and it will!), these truths will be her conversation map to get her team back on track.

3. Third-Level Listening: The CFO’s New Superpower

We all intellectually know that listening is a skill and skills can be learned… but only if practiced… A LOT! But most CFOs stop at level 1 or 2 listening. In our session, we practiced something I learned in my early days of leadership called Third-Level Listening:

Level 1 Listening: Your thoughts and responses to what you are going to say or want to say next. You are mostly inside only your own head and in reactive mode to what you are hearing.

Level 2 Listening: Here, you are doing better. You’ve practiced and practiced and are now truly listening to the other person speaking. You are hearing their point of view without that roommate inside your head passing judgment, reacting, and waiting to interrupt. You are conscious of your biases (and also know you aren’t likely to get rid of them), but you sit with your biases and continue to listen to another viewpoint. You begin listening less to the words and more for the assumptions of the other person’s point of view and not personalizing it. Then you master the art of summarizing what you heard to make sure you are both aligned to their viewpoint before providing your own strong, First-Principled point of view. You now have a better chance at being heard when you challeng their assumptions…and you take care to never challenge them personally.

Level 3 Listening: You’ve now become a listening master. You are now listening to the entire executive room or board room…not just the person speaking. You are actively taking in other non-verbal data cues, including everyone’s body language. You start thinking from the “room’s viewpoint” and even those “not in the room”. You can calmly internalize your CEO or your board member, or your executive team’s ideas, concerns or questions…..without immediately labeling them as crazy, naive, or political.

My client was fluent in Level 1, but she admitted needing to be better at Level 2. Once she understood Level 3, she realized this would have unlocked the room in her last board meeting. I also reminded her that it took me a few years of practice to get good at Level 3 listening. This type of listening is not natural and takes a very concerted mental effort.

Example: Instead of immediately answering a tricky, ratio-based question as a CFO, first pause, then ask this question before you answer: “Can you help me understand what your question is solving for?” By simply answering the “data question,” you are not truly understanding the motive or intent of the person asking the question, and you’ve missed an opportunity to engage on a potential solution.

4. Board Management Isn’t About Defending… It’s About Directing

One of the hardest but highest value skills of any CFO is the ability to push back on the board in a way that points everyone forward, not backward. This is easier when you realize your board, like everyone else, is simply another group of humans who have their biases but who all put their pants on one leg at a time, like everyone else. They are not all-knowing gods. You are doing a dis-service to the room, the company, and yourself by treating them as such.

My client’s challenge: investor pressure to open new markets faster than the company can execute.

She and I worked on building a pre-prepared set of statements (“anchors”) rooted in a set of strategic First Principles for the next time this investor pressure arises.

One example we practiced:

“We are targeting our advertising spend to ensure we deliver X number of leads for our sales team. We are using the following assumptions about our historical conversion ratio of past ad campaigns. Our 70% confidence rate is not a flaw; it’s representative of having our hands on the wheel to ensure we get the best ROI out of this campaign and course-correcting as required.”

Bottom line: Boards don’t really want guarantees. If you give them guarantees, you will lose credibility. They want to challenge you and have you challenge them back. They want conviction paired with adaptability. They ultimately want your hands on the operational wheel and to know you will steer toward success and away from danger.

5. Rewire for Strategic Action: Pre-Decision Incentives

Here’s something more CFOs need to do: create incentives that close your organization’s data gaps.

My client’s executive team was struggling to capture post-sale customer data since their end customer was driven to a third-party dealer, and they lost track of the final customer conversion. The fix?

She/I brainstormed on a unique customer incentive program offering a $500 credit toward add-ons/accessories in exchange for submitting the purchase contract from the dealer. The recommendation was to carve out 10% from the budgeted marketing campaign to fund this unique customer incentive offering. If this is executed properly, it will instantly turn a data blind spot into much more valuable customer data than they ever could have paid for and provide amazing data fuel for the next ad campaign decision.

6. The Future CFO Shows Up Differently

My client’s CEO was noticing a positive shift in her over just the first few months of our coaching relationship. The feedback she is receiving is that she is now leading with much higher conviction and much less compliance and defensiveness. She’s leading with powerful questions, she’s focused on First Principles-based alignment, and she is showing up as a true strategic peer to not only the CEO, but also her executive team and her board.

You can do this too. This just takes a leadership mind shift as CFO to start communicating and operating like the Chief Architect of Strategy that you have the capability of being.

Key Takeaways for North Star Thinking:

Anchor all conversations in 3 or fewer First Principles.

Simplify each First Principle to 3-5 metrics that support and drive every decision.

Practice Level 2 of Listening and then try to graduate to Level 3 of Listening. This is how you can really focus your communications and align the boardroom and your executive team.

Teach your teams how to build a data-to-decision-course-correcting loop that they can run every week.

Say “no” or “not yet” by pointing forward to shared alignment on the First Principles.

The CFO’s real job isn’t reporting - it’s aligning and reframing. Stop answering. Start anchoring. Fewer metrics. Faster decisions.

P.S. Paid subscribers get exclusive access to full blog posts, additional blogs in series, summary framework tables, scorecard templates, and paid subscriber AMA’s (Ask Me Anything) to help you implement the strategies discussed in Cook's PlayBooks. Want to become a paid subscriber and unlock these benefits? Click here!