The ERP Era is Over........................................ The New Era = CFO Intelligence Platform

The New Era = "API-Native + Ai-Powered" Data-Insights-Decision Platform

I’ve got a TON to cover here…so fair warning once again...buckle up this is another long Cook’s PlayBooks Post, so grab your favorite beverage and find a quiet spot. I’m going to be covering:

The Rise of the ERP Era

The Fall of the ERP

The Rise of a New Ai-based CFO Intelligence Platform

Today and Tomorrow’s Market Map of the CFO Tech Stack

Videos, Videos, and More Videos of Some of the Best Solutions I’ve Seen So Far

Let’s get into it…

If you’ve spent time in a finance department over the last 10+ years, you’ve had a front-row seat to an ERP implementation, upgrading it from QuickBooks or other lesser or outsourced accounting systems. I know, I know…..that memory just caused you to sigh heavily.

As Taylor Swift famously wrote….you know this All Too Well:

$1M++ in budget and implementation consultants costing 3-5x the software.

Multiquarter implementation before you get it right.

Robust, redundant, resilient audit-ready systems built like concrete. They work... but good luck evolving these systems as the company evolves.

ERPs were indeed better than QuickBooks but the promise of them being the finance department’s savior? That promise definitely didn’t come to pass.

The ERP Era has passed...it’s over. Trying to patch or inject Ai into your ERP is likely full of more hurt in the future. It’s time to build something new and much better.

We have entered the Era of the CFO Intelligence Platform.

Data warehouse technology has been here for 10+ years now. New Ai technology and capabilities have just arrived. It’s time to build! But what to build and how?

Those of us who were at the Operators Guild CFO Summit Day or following other CFO thought leaders think we know the answer.

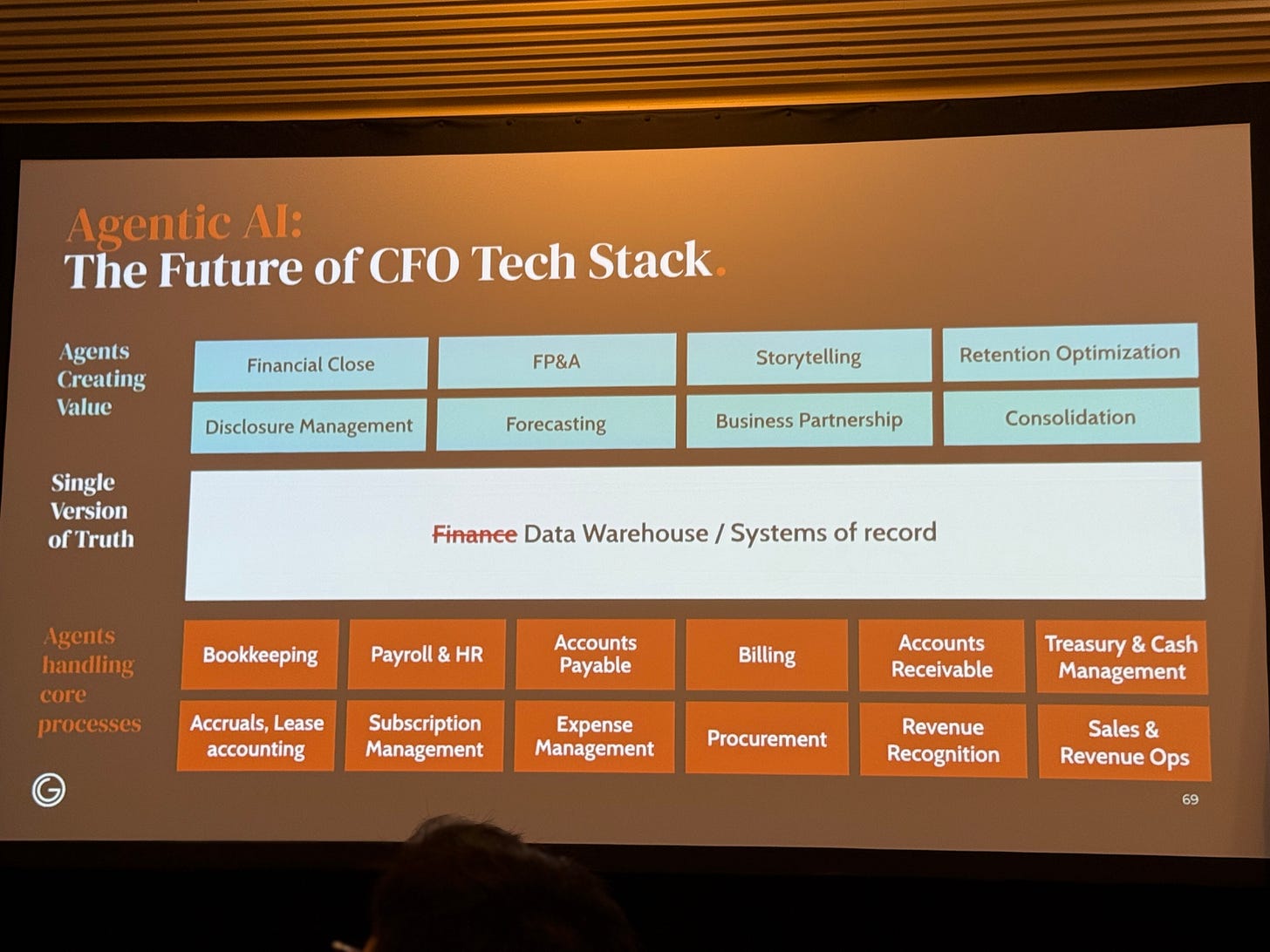

A new finance data layer; a single source of truth; CFO system of record.

An Ai Agentic Orchestration Layer needs to feed this new data layer.

The idea is NOT to replace your current systems but to “Orchestra Conduct” them by integrating API’s into all current SaaS and future Ai systems.

Effectively building your new Ai-powered CFO Platform. Should we call it the CFO LDM (Large Data Model)? We are CFOs after all, and language isn’t typically our strong suit (LLM’s - Large Language Models). But data? Now we’re talking!

I posted this slide below from Wouter Born last week. In that post, I noted that I’d be going deeper. This is that “going deeper” post.

I like documenting and learning from history, so let’s go there briefly…before moving on to our future.

The Rise of ERP:

In the 1990s, businesses became multi-product and more global. CFOs and finance teams found themselves once again behind the curve and drowning in disconnected systems. Finance had its general ledger-based accounting system. HR had its HRIS. CRM and SaaS weren’t even a thing…but hey we had Rolodex’s! None of these data systems talked to each other. Reporting was slow. Forecasting was more guesstimating than estimating.

ERP (Enterprise Resource Planning) emerged as the holy grail.

Platforms like Oracle and SAP dominated the 90s with the promise of a central information platform. NetSuite began to dethrone those giants by the late 2000s by simply moving the ERP to the cloud and putting a nicer UI on top of it. Workday tried to cut in on the dance in the 2010s with their own ERP which began with HRIS and then wedged into the Financial Data world.

One data system to rule them all was the ERP cry. The idea was seductive: a unified, end-to-end system where finance, HR, and operations could all share data in real time, with one common language, one database, and one set of controls.

For CFOs, ERPs delivered:

internal controls and compliance at scale

global multi-entity consolidation

audit-readiness

For IT, ERPs offered:

security

standardization

vendor consolidation

For CEOs and executive teams wanting simple, fast answers?

Cough, cough…while I clear my throat…well, ERP’s came with a price.

Rigid systems, massive implementation costs

Multiquarter rollouts

Dependence on expensive consultants

The Fall of the ERP: Finance Becomes the Bottleneck

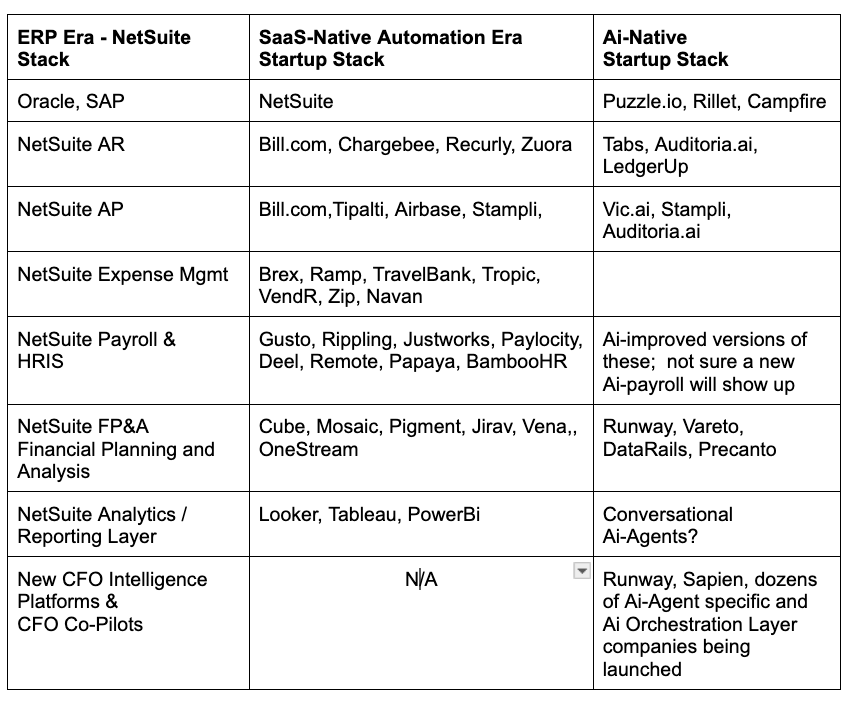

By the mid-2010s, a new wave of finance teams started rejecting the whole concept of an ERP and its “one ring system to rule them all” mantra. 30+ clicks to any ERP solution with a bad UI? Forget about it.

Instead, they assembled best-in-class stacks:

Bill.com began dominating AP (Accounts Payable), then came Airbase, Tipalti and others.

Navan (TripActions) quickly won the travel wars, toppling Concur, Expedia, and other even clunkier systems.

A host of new SaaS payroll providers appeared to dethrone the ADP dinosaurs (Paylocity, Rippling, Gusto).

New spending and procurement platforms? Yes, they also arrived in the form of Brex, Ramp, Tropic, and Zip.

Carta for Equity.

Dozens of others

Zapier to glue other stuff together.

API integrations everywhere else.

ERPs as the sole source of data became the finance equivalent of sticking with cable in the age of streaming. Overbuilt, overpriced, and underwhelming. Once you saw “the future,” it was difficult to “unsee it.” We were UNBUNDLING the ERP with better, faster tools. We just didn’t recognize we were unbundling it until now.

Today’s businesses are demanding more agile, real-time, and iterative operations. ERPs like NetSuite are caught in the classic innovator’s dilemma and feel like they have cement boots on with their custom-coded solutions. Slow and steady and accurate wins the race? Not anymore. Winning = Fast data and good enough data to make decisions.

After about 10 years of ERP’s + point solutions, we woke up in the 2020s realizing our data was siloed and all over the place in many cases without a standard data structure. We needed to integrate with APIs everywhere and bring that data back into the only central repository we knew….the ERP! Noooooo! We screamed. Thank you sir! May I have another?

Here’s the solution. Don’t rip out your ERP. It is still needed for the controls, compliance, and audit-ready financial statements it’s built for. Don’t replace the SaaS systems you just installed, and your end users have just gotten used to — systems they actually like due to their UI and ease of use and made finance teams who promoted them…heroes.

Rather, it’s time to build the “Orchestration Layer” to route around the ERP to deliver the near real-time, data-driven insights your company’s decision-makers need.

Instead of a one-ring-rules-them-all ERP, a new wave of startups is building modular, API-native, Ai-powered components of the ERP stack….one piece at a time.

Here’s a table showing the progression of where we’ve been and where we are going and what today’s agile, AI-native startups are actually using:

Instead of a single monolithic ERP, startups are stitching together modular, best-in-class tools via API-first design and an Ai orchestration layer to create a CFO Intelligence Finance Stack that is:

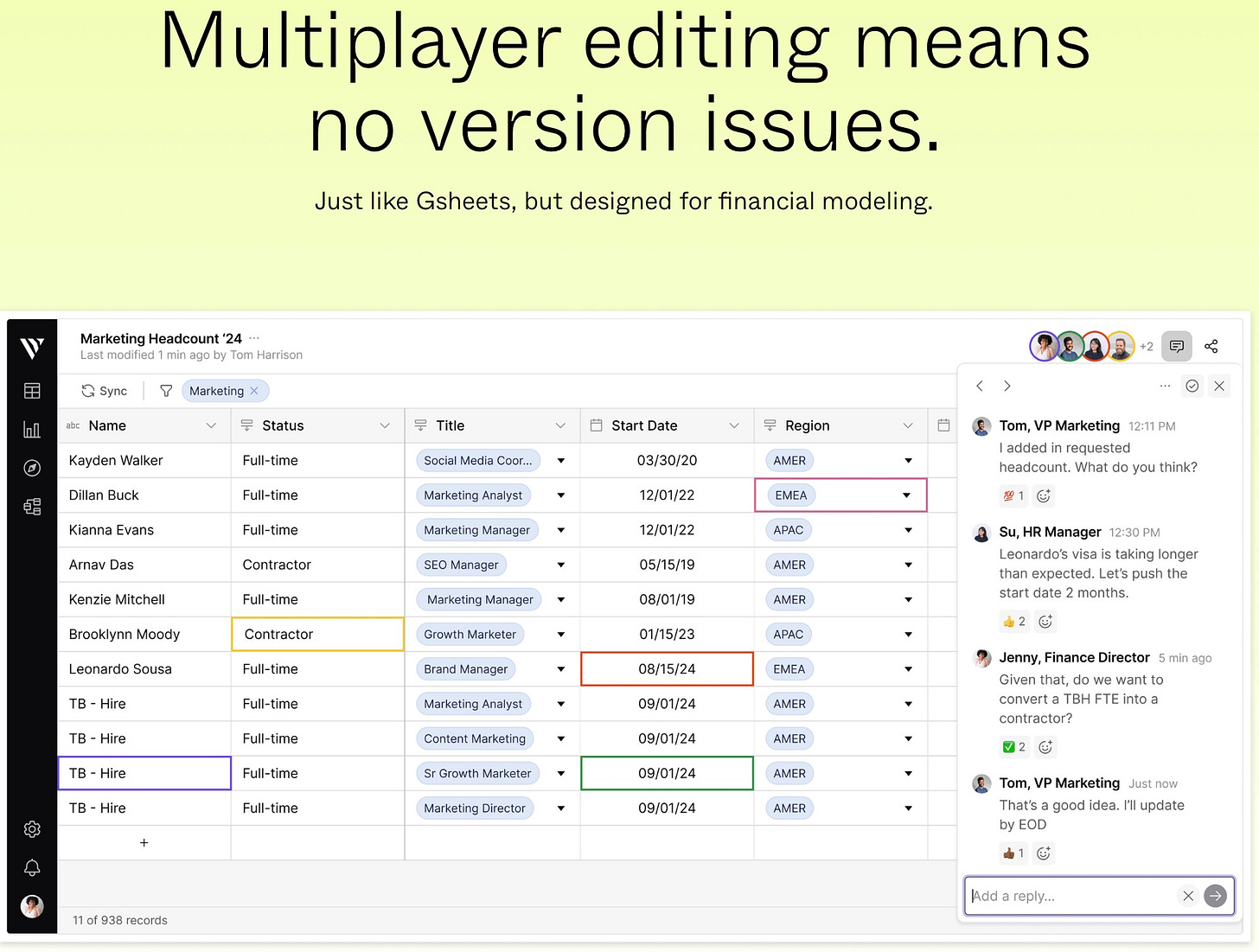

Built for real-time decision-making

More agile to evolve

Results in multi-player collaboration

Ai promises to fix:

Data speed issues (automating manual entries and auto-reconciling other sub-systems)

Data quality issues (ensuring standardized data structures between sub-systems; automatically flagging data discrepancies between systems and having new Ai Agents recommending data definition and workflow solutions)

Data access issues (your finance data will no longer be locked behind your finance team’s walled garden)

Multi-player collaboration (creating natural language queries and conversations between both the Ai and other humans)

Ai Data Layer = the New Financial Operating System

What’s coming next is an Ai-native finance stack:

The ERP Era is dead……..

The New Era = Ai-Based - CFO Intelligence Platform

TL;DR: What Finance Leaders Need to Know

ERP was the mainframe with its large, centralized data center databases. Rigid, slow, 99.9% accurate ruled the day when speed to decisions didn’t rule the day. The equivalent of NYSE paper trading tickets vs. tomorrow’s 24/7 digital trading.

Ai is the internet and the web. Ai is the CFO’s new co-pilot. Open, fast, getting smarter by the day. From reconciliations to reporting, intelligent agents will take over all data entry tasks, most reconciliation tasks, and will soon do the 1st pass of all Journal Entries.

The next-generation finance stack is modular and dynamic. Don’t buy or patch your current platforms. Build a new single source of truth, an Ai data layer system (Language Data Model - LDM) and plug in Ai Agents to talk to each other.

The future CFO is an Architect + Orchestra Conductor……no longer a Controller. Spend your time on creating valuable insights and judgment…not on journal entries.

I've had this post "in the can" for a few weeks, and as I was prepping to launch it this week, this great Norwest Market Map (below) just showed up in my LinkedIn feed. Serendipity? or more "algo genius"? Either way, I'm sharing it with all of you.

This is today’s “Market Map” of the CFO Software Stack.

I'm fired up! I haven't seen this much activity in the form of new software and automation in my entire career spanning 30 years in Silicon Valley. Add in the incoming wave of Ai solutions, and it’s going to be fun to be in finance again! Especially if you are a curious learner, innovator, and builder. If you aren’t, then we need to talk privately. CFO meet woodshed.

I encourage you to be as excited and curious as I am. Carve out time and click the links below to immerse yourself in the future vision of finance. These concepts and techniques need to be studied, learned, and implemented. Learn It, Do It, Teach It!

Once again, I’m sharing my "Best Of's" below because I've been in your seat. I wish somebody would’ve had the time to research, curate, and bring me what they thought was the "best" out there when I was an operating CFO for 20+ years.

So without further ado, below is just the tip of the iceberg. Those of you following along with so many other LinkedIn and Substack posts know this avalanche is coming, finally bringing our finance departments out of the ice age and into the modern age of data-insights-influence.

So cue the Rillet.com video below...and then keep going with Siqi Chen and his awesome Runway.com video.

The ERP is coming out of the ice age (Rillet) - P.S. The Rillet video showed up just yesterday. I quickly edited this post and decided to expand it with "Show" and "Don't just tell."

Runway.com - Siqi Chen

Here is a great example for anyone scratching their head on how all this new software works together (or should work together) as the new "Orchestration Layer" for the business. You, as CFO or finance leader, need to be the "Orchestra Conductor" - pulling in data - pushing out data, and keeping the "data music" flowing.

Rev Rec from Tabs. Pretty damn cool:

Puzzle.io - Follow Sasha Orloff - he’s an incredible visionary.

Aleph

https://www.getaleph.com/platform/overview

Need more help getting started?.....here's a shout-out to my last post:

Greg Shove's Section.ai

https://www.sectionschool.com/events/become-an-ai-leader-in-a-day

This link is essentially the same “day” I had at HumanX with Greg Shove, Ashley Gross, and Edmundo Ortega that I posted about last week.

Sign yourself up or sign up one of the hungry and curious future Ai leaders on your team to join a future "Ai Leader In A Day" - with Greg and the team…you won’t regret it.

And finally, Paul Barnhurst is amazing!

If you want to focus on just FP&A - this is the definitive guide: (www.FPandAguy.com)

Please send me others you find/like and I'll add them to this post!

P.S...I'm not getting paid by any of these companies for anything...yet...but I’m not allergic to sponsorships - Hint! Hint! I’m simply sharing because I’ve been personally involved with nearly all of the above.

Mostly, I'm just insanely curious about how our finance stacks and our CFO Intelligence Platform is going to be revolutionized within the next 5 years. We are all going to wake up in 2030, look back at 2025 as the inflection point, and realize we were in the finance dark ages as late as 2020.

Chat with me here on Substack (you must be a paid subscriber to do so) if you want to go more in-depth on any of these new companies or even just to ask questions.

OR join my upcoming Live Zoom AMA (Ask Me Anything) next Friday, April 11th - again, only available to paid subscribers.