Your Network Is Your Net Worth

Playing the Long Game of Career Capital = Continuous Learning + Reputational Equity

Cook’s PlayBooks is proud to partner with Brex, the modern finance platform built for high-performing CFOs. Brex unifies global cards, expenses, travel, procurement, banking, and bill pay into one AI-powered solution, giving finance teams the visibility, control, and speed to scale. Get started today and see how your peers are getting more leverage from finance with Brex.

In finance, net worth is simple math: Assets minus Liabilities. People and especially executives don’t often think of having a personal balance sheet, but it’s always there behind the scenes. It’s built on people, trust, learning, and reputation.

Let’s redraw the equation:

Your Network Assets are your trusted connections, mentors, and sparring partners who elevate your judgment, open doors, challenge you, and push your thinking.

Your Network Liabilities are the time-draining, reputation-risking, one-sided relationships that leave you exhausted and defensive.

Just like financial capital, career capital compounds.

Your Professional Net Worth = Network Assets – Network Liabilities.

Reputation: The Asset That Can’t Be Rebuilt Overnight

Reputational IP is the equivalent of the intellectual property that others associate with your name, your decisions, and your integrity. It’s the sum of your judgment, reliability, candor, and ability to deliver under pressure.

Strong Reputational IP earns you access, influence, and second chances. It travels faster than your resume. Your reputation is what precedes you into the room and lingers after you leave.

Reputational Bad Debt? When you take shortcuts, break trust, or tolerate sloppy execution and bad behaviors. Accrue too much debt and you will either get written off (a.k.a. - Fired) or go “network bankrupt.”

Your reputation is your career’s equivalent of the IP on the balance sheet: somewhat intangible but massively valuable. Your reputation shapes how others allocate time, money, and future opportunities. Whether you are top of mind. Whether they call or refer you to help them fill their next gap.

Reputation is either compounding or depreciating. A single shortcut, a missed follow-through, a behavioral blowup, or a quiet betrayal creates Reputational Debt, and debt usually always comes due at some point.

Learning: The Operating System of Growth

More language metaphors:

Learning Growth = your continuous shared learning through peer groups, advisors, dinners, newsletters, podcasts, and inside conversations. Learning Growth is your equivalent of Revenue Growth.

Learning Time = the time it takes you to learn and adopt new tools or gain new knowledge. The time it takes you to create new leadership behaviors. Learning Time is your equivalent of Operating Expense (OpEx).

Learning Growth – Learning Time = Net Learning Income

Bottom Line:

Learn faster over time and compound your net learning income.

Three Powerful Questions to Benchmark Yourself

I spend a lot of ink on this newsletter talking about powerful questions.

Here are three good questions on this topic:

How do I increase my valuable network assets?

Are you using your knowledge and influence to make sure you are in the right decision rooms with the right people? When you are in those rooms, are you focused on building trusted relationships?How do I reduce the time it takes to learn new tools and techniques?

Think about building learning systems for your teams, adopting AI, staying close to your peer networks, and storing your own knowledge playbooks.How do I avoid Reputation Debt?

Say what you know. Say what you don’t know. Speak your truth and make sure you deliver what you commit to. Follow-through. When others describe you, hopefully, you hear “trusted, consistent, team player.”

Final Thought: Upgrade the People Around You

Your network environment is your career leverage. You become who you hang around. Upgrade your network. Upgrade your thinking. Go to that network event you were going to pass on because you were too tired. When you are there, focus on meeting and following up with one key person. Two follow-ups and new network connections are a bonus. Ask these new connections lots of questions (that “learning” thing I mentioned above). Respectfully challenge them and allow them to challenge you.

This is what’s called “Collective Intelligence”. People who seek the best ideas raise the collective intellectual knowledge level and help each other with execution.

At the end of the day, Your Network = Your Career Net Worth.

Your network isn’t about vanity LinkedIn metrics or Substack followers. It’s about your capacity to create impact, to help navigate complex decisions with better inputs, faster learning, and having a group of experts you trust and can turn to each other in the hardest times.

ROR - An Operating Framework for Return on Relationships

If your financial systems track ROI by customer, product line, and marketing channel… why wouldn’t you do the same for your professional network? I just made up ROR, but maybe you’ll remember it.

Your network is both social and strategic. Here’s a framework to evaluate your Network Capital, flag areas of Reputational Bad Debt, and design a Shared Learning System to increase your Career Net Worth.

1. Relationship Balance Sheet

Map your current network using an Assets vs. Liabilities framework:

ACTION: Rate each relationship from -5 to +5 based on value contributed vs. value drained in the past 6 months. Prune, reconnect, or reinvest accordingly.

Network Assets

Key Peers

VCs and Board Members

Trusted Advisors

Network Liabilities

Transactional contacts

Takers not Givers

Time Drainers

High Risk Reputation Contacts

2. Reputation Risk Checklist

Reputational IP takes years to build and minutes to damage. Here’s a self-audit to spot Reputational Bad Debt:

Am I procrastinating and not following through for somebody in your Network Assets column?

Did I unintentionally drop a commitment this week or this month?

What email or phone call or meeting am I not making happen?

Have I referred people into roles, boards, or deals who failed to deliver?

Am I connected/partnered with somebody who is behaving badly?

ACTION: Identify 1 relationship where trust has degraded. Take action to repair or clarify your personal 1st principles with this relationship this week/ this month.

3. How to Repair a Damaged Relationship

Use the 3-A Framework: Acknowledge, Apologize, Align.

Acknowledge what happened. Be specific and own your side without deflecting.

Apologize sincerely without over-explaining or making it about you.

Align by expressing what you’ve learned, how you operate now, and why you still value the relationship.

ACTION: Here’s a script to reopen a door. You’d be surprised how often trust can be repaired with this kind of maturity, clarity, and vulnerability.

“I dropped the ball, and I regret not handling it better. I’ve learned how I need to follow up faster and more proactively. I still greatly value your perspective going forward, and I’d like to gain your trust back.

4. CFO Network ROI Framework

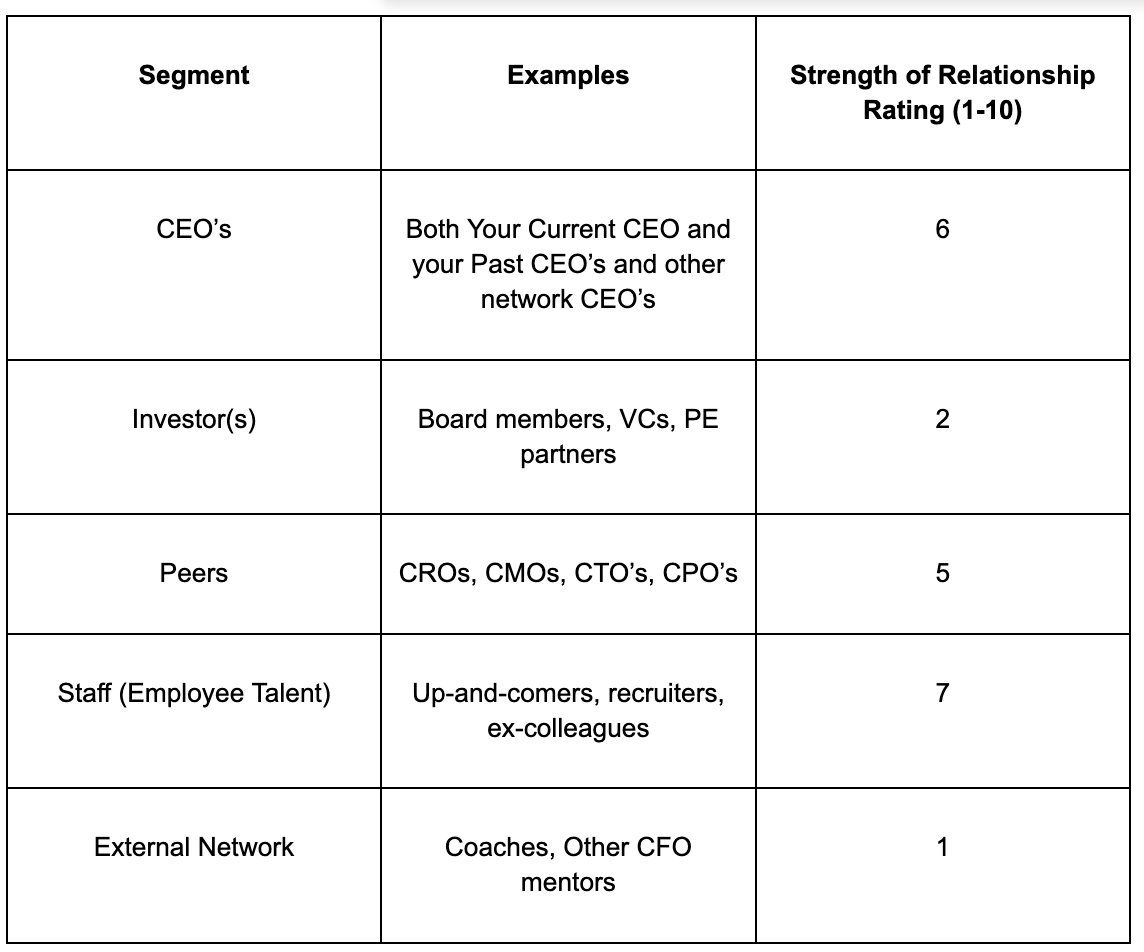

Segment your network like you would a strategic portfolio:

ACTION: Do a network gap analysis. Where are you over-indexed? Where are you under-networked? Pick 1-2 relationships to increase your score over the next 6 months.

Final Thoughts: Your Network = Your Career Net Worth

You should review your personal network balance sheet every so often.

You are the Chief Architect of your relationships. Design the network that can support your next 5-10 years.