Relevancy = Execution Velocity

Why Finance Leaders Must Move Faster to Stay Relevant in the Age of Ai

One key theme that has rung true over my entire career is this concept:

“Your Relevancy is Directly Proportional to Your Execution Velocity.”

You may have heard me using similar 1st Principles of Finance with different language (a.k.a - “7 times 7 different ways).

You must move at the same speed as the business

You must deeply understand the business in order to create influence

Today, the definition of “speed” is changing exponentially with our new Ai capabilities.

The Coming Gap in Execution Velocity

So, “Mind the Gap”! « the thing I wrote about last week.

Here’s a fantastic recent post by Aaron Levie to emphasize my point:

A massive and widening gap is starting to form between individuals, teams, and companies that adapt their workflows to AI agents… and THOSE THAT DON’T.

The best individuals, department teams, and companies are already operating in a totally different way than the rest of the world. Their ambition is not about getting 10% faster. It’s about re-architecting workflows so their organizations are 10X faster.

Aaron Levie - CEO of Box

While Engineering and coding are ahead of the curve today, vibe coding is coming to all other business functions and must be adopted to keep up to speed.

Marketing: Generating new campaigns and content at 10X velocity and faster fine tuning of their A/B testing

Legal: Accelerating their deal review and contract approval processes for both customers and vendors

Customer Success: Handling customer inquiries faster with higher quality issue resolutions.

Finance & Ops: Faster forecasting, closing books, preparing board materials for higher velocity and quality business decisions and course corrections.

The Core Lesson for Finance Leaders

We’ve learned these lessons historically as we moved from desktop to cloud and to mobile. There will soon be a clear separation of finance teams who innovate with Ai agents and Ai automations vs those teams who continue to operate with more cautious incremental gains. The former will find increased relevancy and influence. The latter will start falling behind and worse put the business more at risk by not operating at the same speed of the other departments.

Our executive peers and cross functional department teams are expecting this from us in finance more than ever today. Don’t let these expectations vs reality create a widening gap. You and your teams relevancy and ability to influence critical future business decisions are at stake. You must push to invest in your finance teams new capabilities and team behaviors. These are table stakes now. We must begin re-architecting our financial workflows and internal & external financial system interfaces. We must become fluent in Ai and Agents. It’s the new language of business.

To Summarize: Your Call To Action:

If you’re a CFO, COO, or finance leader, your job is to start re-tooling today. While this may seem daunting and technically hard, the opposite is actually true. You and your teams only requirements are having a clear vision or point of view of what “better” looks like when interacting with your current finance team and systems. Hard stop. You must develop a clear point of view of “faster and better” and then you must then start “telling the computer to build it”. That’s it.

You only need human language today to code. You must step outside of your comfort zone, put your hands on keyboard (or dictate it into the vibe coding interface) and the computer will build it for you. No excuses. You must change your own leadership language from “I don’t have time to experiment and build” to “We can’t afford to waste time and we must start this today”. As one of my Operators Guild colleagues so accurately said at a recent event we both attended….”It’s now clear to me this is all very doable today….the only possible blocker to getting started is me”

So just start!

Invest in your team by giving them a Lovable or Cursor or Replit (or other vibe coding app of choice).

Schedule 1 hr “all team” sessions every 2 weeks with snacks and drinks (if in office) or all zoom if remote and make sure everyone logs in to the vibe coding app and creates something…anyting

This is a new “language of learning” for everyone. No different than how we all had to learn Excel at one point. Except this is easier than learning Excel.

Ask each member of your team to re-imagining a workflow (any workflow) that frustrates them and ask them to ask the computer (the vibe coding app to build it better)

Lead by example….Show them…don’t tell them. Make sure they see you as the leader doing this and make sure you say “If I can do this, I expect all of you to do this regularly”. That “Expectation” thing is powerful! Use it!

Ask powerful questions such as “Where can we get 10X speed”

Once individuals being getting comfortable with their powerful new tool, now have them start collaborating together in teams in “Hackathon Sessions” with prizes for “this week’s best idea” and “this months best new implementation”

Ask individuals and small teams to “Show and Tell”. Explain to the rest of the team what they did, why they chose this new idea, what prompts they used, what they learned in the process, etc.

Your team’s new innovation culture will likely transform almost overnight and the downstream results will surpass your expectations.

Relevancy is the prize. Execution velocity will separate the leaders from the laggards.

More Ideas On Designing Agentic Finance Workflows

I hope I’ve made the case that execution velocity is becoming the new currency of relevance.

Here’s some brainstorming to get you started on your new workflow designs.

1. Forecasting with Agents

Traditional forecasting is built on rolling spreadsheets, department submissions, and endless meetings. The agentic version:

Agents ingest real-time operating data (sales pipeline, hiring plans, SaaS metrics)

Agents tag assumptions with confidence scores and risk scores (see my [Risk Equation Framework: Risk = Probability x Severity])

Humans review, challenge, and adjust the past assumptions, create new ones, and re-build the model on the fly

Result: Forecasts update continuously, with CFOs focusing their time on influencing business assumptions, not fixing formulas.

2. The Close

The month-end or quarter-end close is ripe for automation:

Agents reconcile transactions against expected patterns.

Exceptions are flagged and surfaced for human review.

Journal entries are prepared for final review. No more manual keying.

Result: A close cycle that’s days, not weeks. Your team spends time analyzing outcomes, not chasing missing entries.

3. Board & Investor Materials

Preparing board decks used to mean weeks of manual PowerPoint and Excel grind. In an agentic workflow:

Agents pull the latest financial and operating data

Draft materials are auto-assembled into pre-agreed templates

CFO and CEO apply judgment on narrative, risk, and opportunity

Your new “Board Agent” reviews your deck and preps you with the FAQs that are coming. Note - I’ve already seen this in action today with some of the most futurist leaders in Ai. Their success rate on predicting the Board questions? +90%. Amazing.

Result: Finance leaders reclaim time for strategic dialogue with the board instead of formatting slides at 2 a.m.

4. Decision Support Systems

This ties back to my Decision Making Series. Every major decision should flow through a framework of:

Defined owner (who really decides?)

Supporting financial data, built by agents

Risk and opportunity scorecards

Metrics to review whether the decision succeeded

Agents can build the inputs. Humans still own the decision.

5. Compliance & Controls

Agents can run continuous monitoring on transactions for anomalies

Control evidence can be auto-assembled for audits

CFOs can shift the team’s bandwidth to designing better controls, not just checking boxes

The CFO’s New Role

The CFO has always been part scorekeeper, part strategist. In an agentic world, you must also be the Chief Architect of Finance Workflows.

Your job is to design the system where:

Agents execute

Teams review, challenge, and escalate

You influence the business with speed and insight

FINAL WRAP:

Today, if you can think it you can build it. Your only blocker is your willingness to get started and to not be late to the party.

Execution velocity is no longer just about delivering the numbers faster…. It’s about re-architecting how the finance team and its systems integrates with the business.

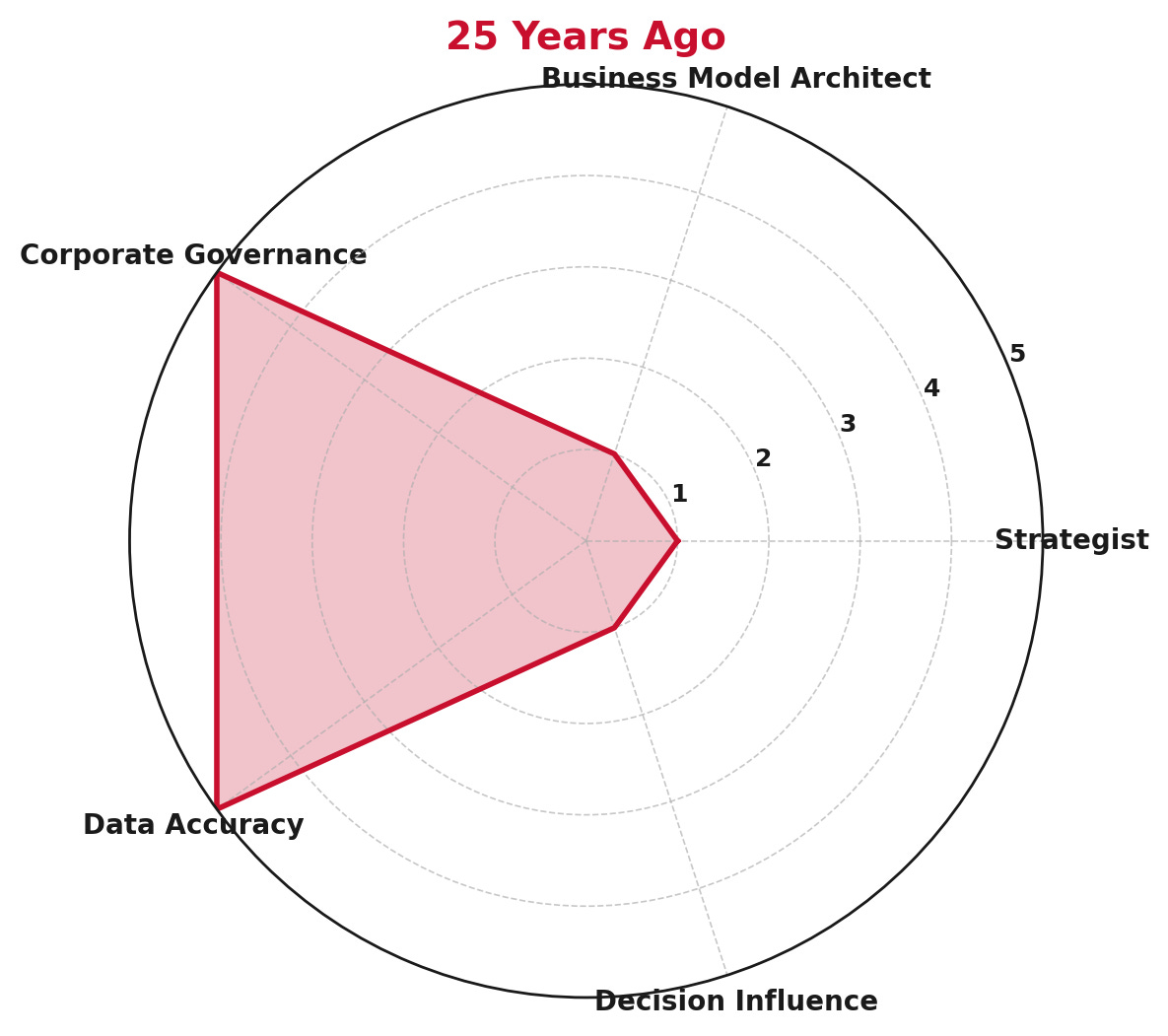

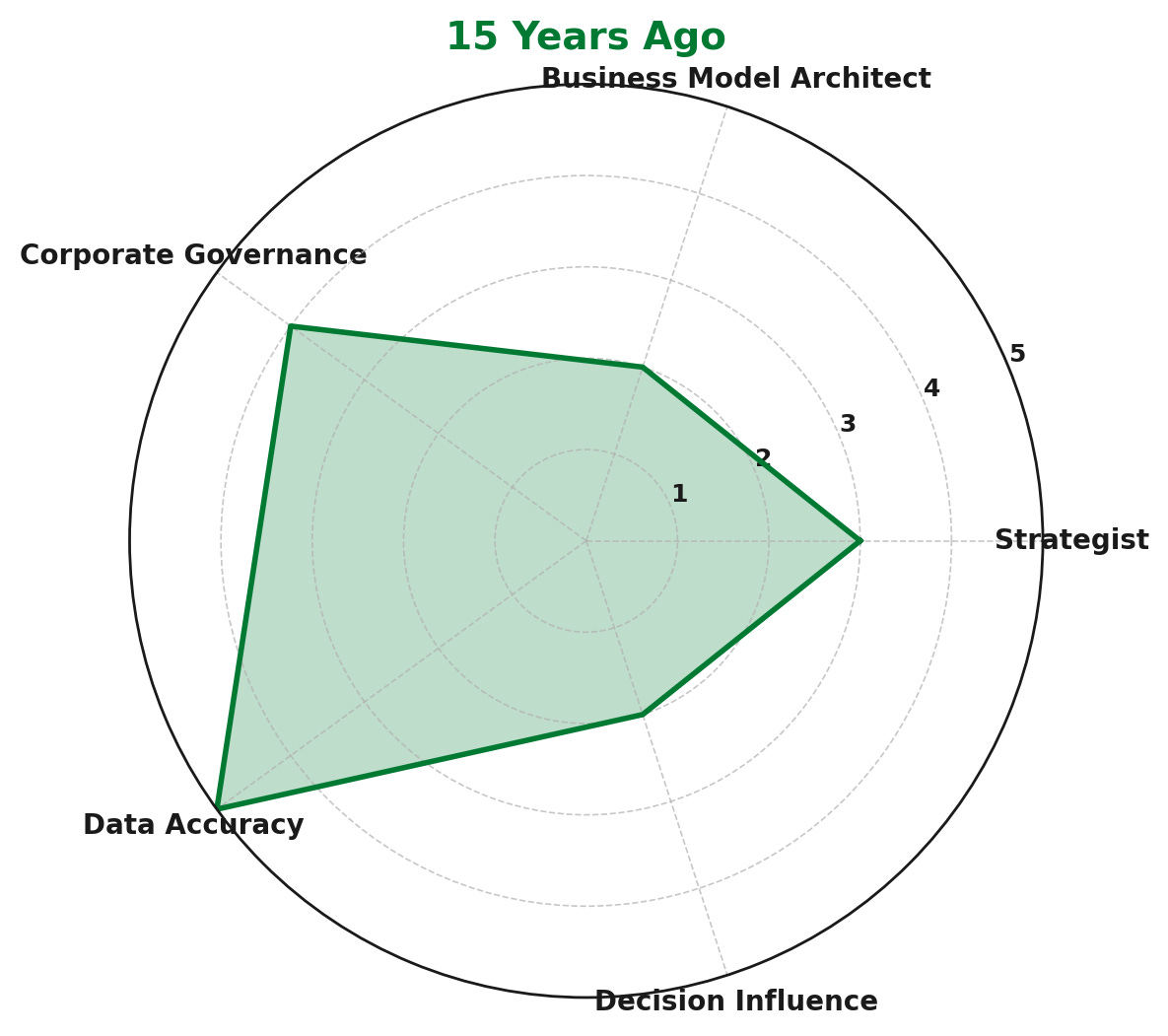

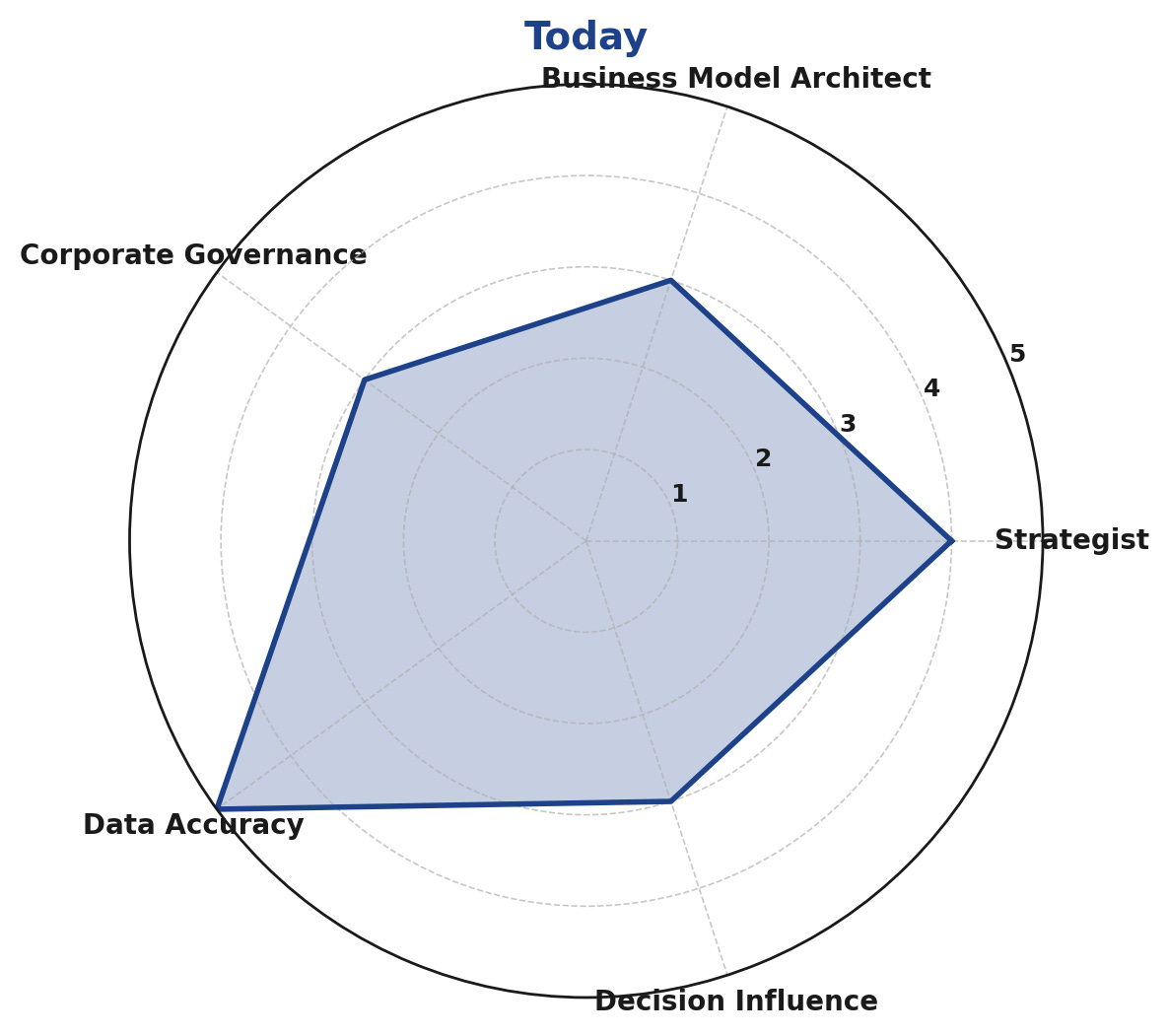

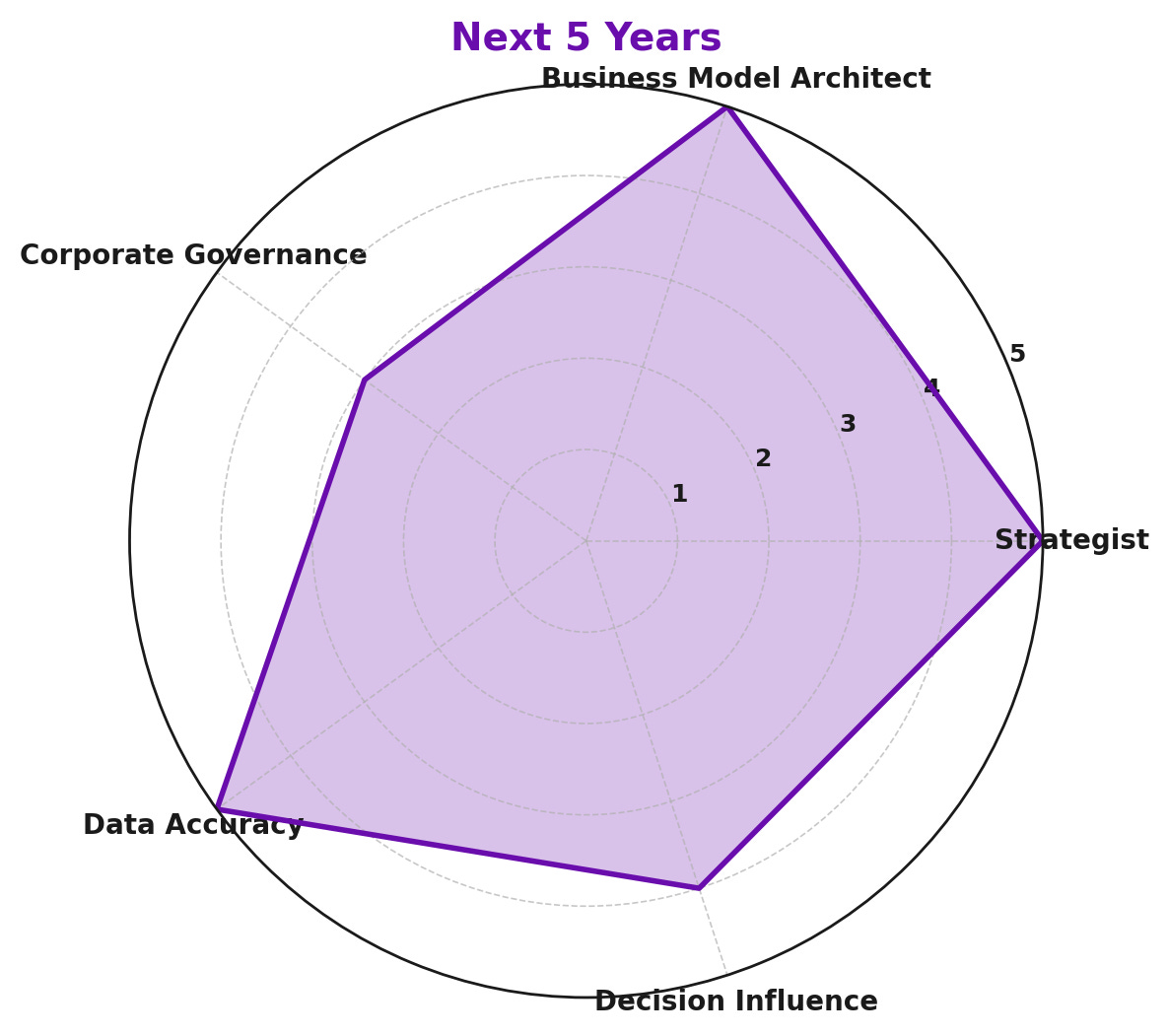

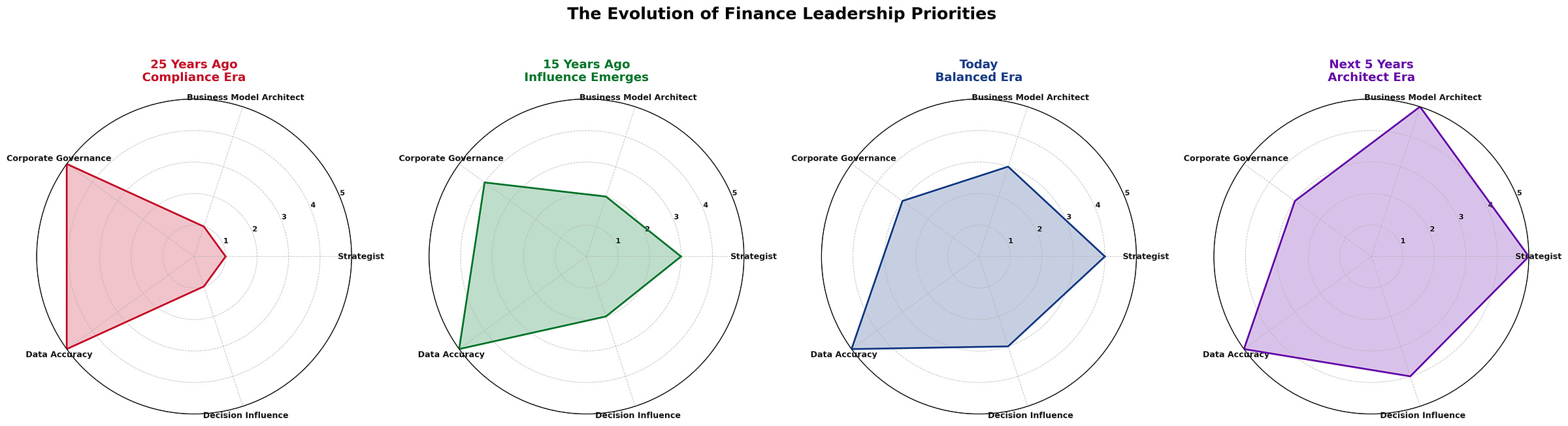

Here are a couple of images I just created to try to capture where we’ve been vs where we are and where we need to go using 5 key pillars of Finance (Corporate Governance; Data Accuracy, Decision Influence, Strategy, and Business Modeling)

Looks like a flashlight beam to me… so I’m going to call this “Widening the Finance Beam of Influence.”

Your Future Relevance = Your Future Execution Velocity. The time is now. The tools are here. Your future ability to influence and grow the business is at stake.

Leading by Example; I “Walked the Walk” by Vibe Coding a new “Cook’s PlayBooks Chat Interface” and hit “publish” to the world..even though it’s not quite fully ready..but it’s good enough. For those that missed that post from yesterday. Here it is

Ask Jim: https://askjim.benchboard.com - super beta but built in less than 1 hr with Vibe coding.

Until next week….stay tuned…